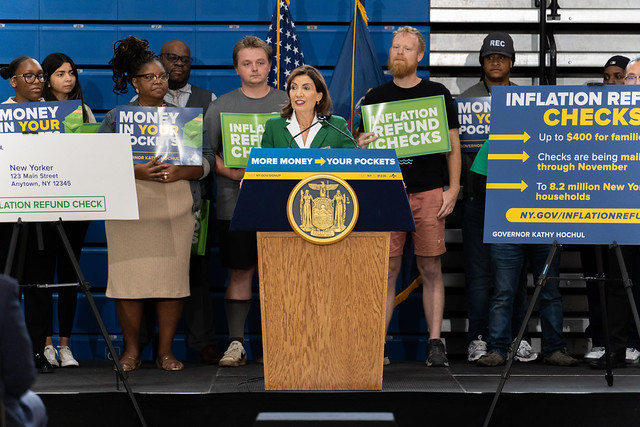

New York’s mailboxes have been a little heavier these past few weeks, and not because of holiday catalogs or political flyers. Governor Kathy Hochul says the state has now dropped more than 8.2 million Inflation Refund Checks into the postal system essentially finishing the biggest direct-aid mailing effort New York has ever attempted.

For a state where affordability has become the most painful household conversation, this marks one of Albany’s rare moments of bipartisan applause.

What New Yorkers Are Receiving

The refunds, capped at $400 per eligible taxpayer, were authorized in the FY 2026 State Budget and totaled $2.2 billion statewide. Hochul framed the initiative as a straightforward attempt to ease pressure on households still fighting stubborn grocery prices, higher borrowing costs, and rent hikes that continue to outrun wage growth.

State officials say the “main phase” of distribution is now essentially complete, though smaller batches will continue to trickle out as the New York State Department of Taxation and Finance finishes verifying late-filed returns. The agency has been posting updates through its usual taxpayer channels, most of which live on tax.ny.gov, the same place residents typically check refund status or mail delays.

Below is the regional breakdown released by the Governor’s Office:

| Region | Beneficiaries | Total Benefit ($M) |

|---|---|---|

| Western NY | 585,000 | 152.7 |

| Finger Lakes | 513,000 | 134.3 |

| Southern Tier | 251,000 | 66.7 |

| Central New York | 321,000 | 83.8 |

| Mohawk Valley | 198,000 | 52.4 |

| North Country | 156,000 | 42.4 |

| Capital Region | 475,000 | 122.8 |

| Mid-Hudson | 924,000 | 234.2 |

| New York City | 3,536,000 | 828.8 |

| Long Island | 1,251,000 | 316.4 |

| All Regions | 8,210,000 | 2,035 |

The concentration isn’t particularly surprising: New York City alone accounts for nearly 43% of all checks mailed.

Why Albany Pushed This Refund Now

Inflation has cooled nationally compared with 2022 levels, but the lived experience in New York tells a different story. Service-sector prices remain sticky, housing affordability remains brutal, and seniors on fixed incomes have been squeezed hardest.

Hochul’s message “putting money back into the pockets of individuals across the state”—aligns with a broader affordability platform she has been rolling out since early 2024, documented across her administration’s policy bulletins on ny.gov.

According to state budget analysts, the refund is intentionally unrestricted, meaning residents don’t need to justify how they use the money. That distinguishes it from traditional relief programs tied to fuel, rent, or utilities.

The Governor’s team views this as a rapid, universal injection—something similar to the stimulus-check strategy used during the pandemic but funded at the state, not federal, level.

How This Fits Into the Broader Affordability Agenda

The Inflation Refund Check is just one piece of a wider package Hochul has been pitching hard since last year. Other components include:

- Middle-class tax cuts, bringing some brackets to their lowest levels in roughly 70 years, according to published budget summaries available on budget.ny.gov.

- An expanded Child Tax Credit, up to $1,000 per child, aimed at families squeezed by childcare and after-school costs.

- Universal free school meals, a policy expected to save families around $1,600 per child yearly, based on state education department estimates.

Taken together, Albany sees these measures as a response to families who say that even with full-time work, their budgets feel like they’re running uphill.

What Happens If You Haven’t Received Your Check?

The Tax Department says some late mailings will continue into early winter as it reconciles additional taxpayer data. Anyone who believes they should have received a check but hasn’t can verify eligibility or update mailing information through the Tax Department’s portal on tax.ny.gov.

Residents can also call the Governor’s Press Office (listed at the bottom of the release) for general program questions, though tax-specific cases should go through the agency itself.

Fact Check: Is the “Inflation Refund Check” a Real Program?

Yes—this is official New York State policy, documented in:

- The FY 2026 Enacted Budget (budget.ny.gov)

- Press releases from the Office of Governor Kathy Hochul (governor.ny.gov)

- Statements and distribution updates from the New York State Department of Taxation and Finance (tax.ny.gov)

There is no evidence of misinformation or fabricated claims in this case. The checks are real, have already been mailed, and are funded through the state budget, not a federal program.

How to contact if you have any query

| Contact Method | Location | Details |

|---|---|---|

| Phone | Albany | (518) 474-8418 |

| Phone | New York City | (212) 681-4640 |

| Governor’s Press Office | Press.Office@exec.ny.gov |

About $400 Inflation Refund Checks

The 2025–2026 New York State budget provides for the state’s first-ever inflation refund checks. These one-time payments provide relief to New Yorkers who have paid increased sales taxes due to inflation. If you qualify for a payment, you do not need to do anything; we will automatically send you a check. Checks will be mailed over a period of several weeks starting at the end of September 2025.

Am I eligible?

You are eligible for a refund check if, for tax year 2023, you:

- filed Form IT-201, New York State Resident Income Tax Return;

- reported income within the qualifying thresholds below; and

- were not claimed as a dependent on another taxpayer’s return.

How much of a refund will I receive?

The amount of your refund check depends on your income and filing status for the 2023 tax year:

| Filing status | 2023 New York Adjusted Gross Income (Form IT-201 line 33) | Refund amount |

|---|---|---|

| Single | $75,000 or less | $200 |

| more than $75,000, but not more than $150,000 | $150 | |

| Married filing joint | $150,000 or less | $400 |

| more than $150,000, but not more than $300,000 | $300 | |

| Married filing separate | $75,000 or less | $200 |

| more than $75,000, but not more than $150,000 | $150 | |

| Head of household | $75,000 or less | $200 |

| more than $75,000, but not more than $150,000 | $150 | |

| Qualifying surviving spouse | $150,000 or less | $400 |

| more than $150,000, but not more than $300,000 | $300 |

When will I get my check?

We began mailing refund checks to eligible taxpayers at the end of September 2025. Over 8 million New Yorkers will receive refunds, and this large volume of checks will be mailed over a multiple week period. You may receive your check sooner or later than your neighbors, as mailings are not based on zip code or region. We cannot provide a specific delivery schedule, and our Contact Center representatives will not have additional information on the status of your check.

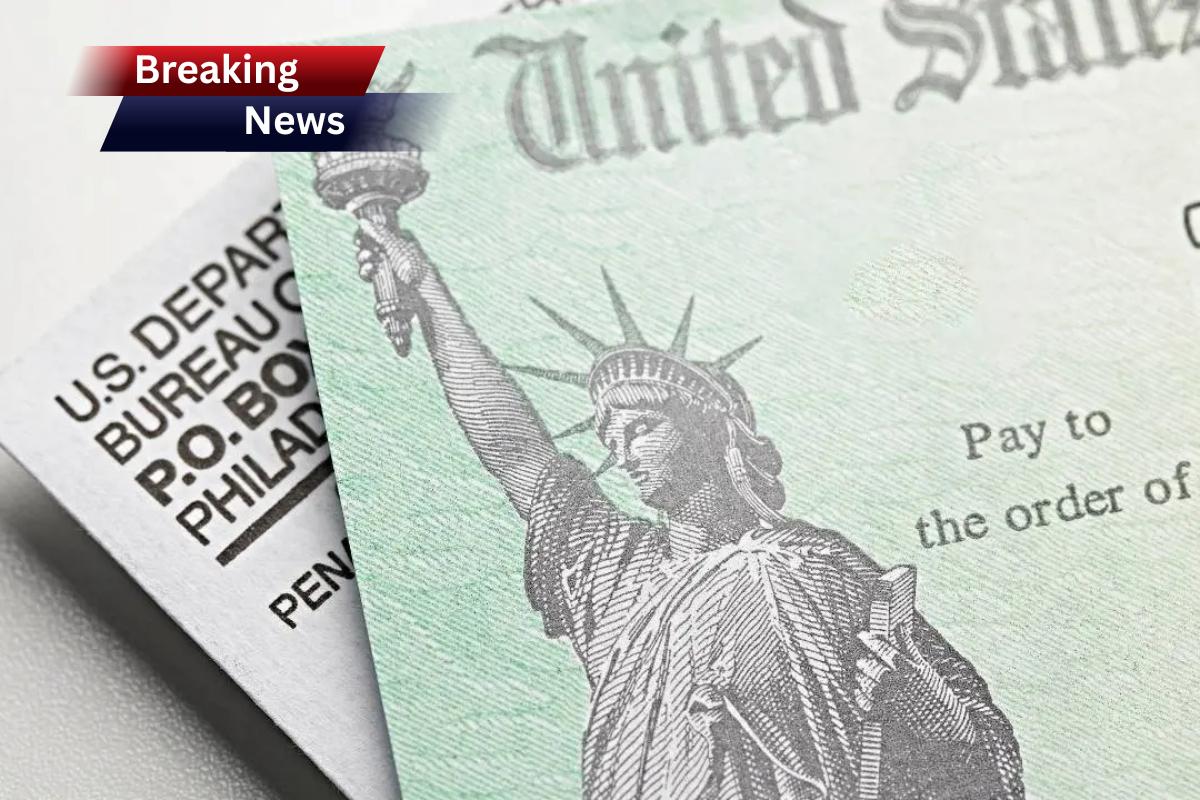

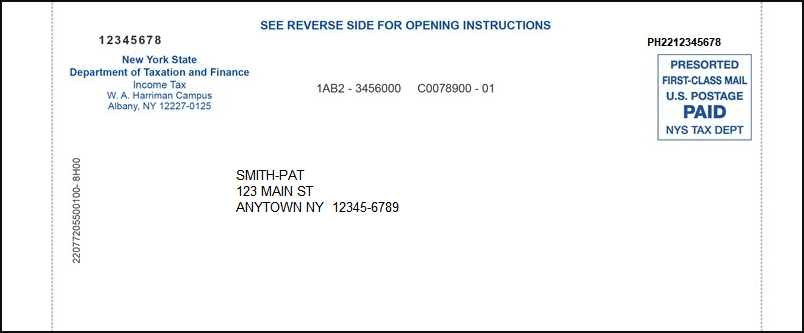

Watch your mailbox for a check that looks like this:

FAQs

1. How much is the Inflation Refund Check?

Up to $400 per eligible taxpayer, depending on tax status and state calculations.

2. Do New Yorkers need to apply for the refund?

No. Eligibility is based on tax filings already on record with the state.

3. What if the check was mailed to an old address?

Residents can update mailing information with the New York State Tax Department.

4. Is this refund taxable?

Generally, state-issued rebate checks aren’t considered taxable income at the federal level, but residents should confirm with a tax professional.

5. Will there be another round of checks next year?

Hochul hasn’t committed to a repeat program. Future rounds depend on the FY 2027 budget process.